As a Caregiver, This Counts as Care:

One way I provide caregiver help is with administrative issues. As a caregiver, I know that eventually, the day will come when I will need to settle my parents’ affairs (or so I hope, given I outlive them). That’s why I recently followed my own advice, from a previous blog, to document my parent’s accounts, along with the account numbers, usernames and passwords. In the process, I created a template I hope will help you. (see below)

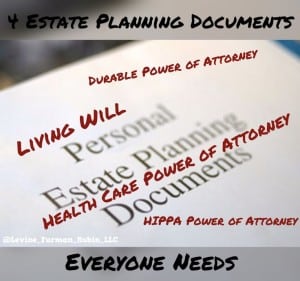

Here’s a little reminder about the legal documents you need to help make life easier in the long run. Below is a quick reference list:

Will: Designates who will receive your property when you die (beneficiaries), including designating guardianship for minor children

Names an Executor (the person who will execute the will).

Living Will: Defines your specific end-of-life wishes, such as any life-saving efforts you do/don’t want.

Durable Power of Attorney- Health Care: Designate a person to make health care decisions for your care (not end of life). Lasts only as long as you are incapacitated and can’t make decisions for yourself. You can include specific end-of-life wishes also.

This Durable Power of Attorney for Healthcare is an easy place to get started.

This Health Care Power of Attorney-form is more thorough, including information of a living will.

You can have both a Living Will AND a Durable Power of Attorney (POA)- Health Care

Trust: Designates how your assets will be distributed before your death, based on a timeline you determine.

Name a Trustee who will distribute the assets to the beneficiaries. (The Trustee can be the Beneficiary. There can be more than one Trustee and/or Beneficiary.)

Pour-Over-Will: Moves assets from an estate to a trust when you die.

Lady-Bird-Deed: aka Enhanced Life Estate Deed, transfers property to a designated person when you die (not legal in all states).

Do you really need any of these if you are married? Yes. Married caregivers need this in the event their spouse becomes incapacitated.

When both partners are named on property documents (real estate, accounts, etc.), then any changes (sale, transfer, etc.) may require both signatures. If one person can’t sign you may need to get a court order to appoint a guardian, which is costly and takes a lot of time.

Think of it this way:

Do you carry insurance on your house and car? Do you expect to your house to burn down? Or to get into a car accident? Probably not, but you prepare for it just in case. It’s the same with these documents. It’s best to be prepared in case you need them. You can always change them.

You don’t necessarily need an attorney to prepare some of these documents (start with the forms we’ve included in this post). But the more complicated estates should call on an elder law attorney to help avoid problems down the road. You will a Notary Public for some of the documents. (a few places you might find a notary are: police station, library, UPS office, city hall, etc. Here’s a great article on this: Here’s How to Find a Free or Cheap Notary . You should be able to find a notary public who will come to your home if necessary.)

Please don’t wait. Get started. Practice with your own personal affairs.

I put together a template to help me document all my personal and financial information. Hope it helps you: GetItTogether-Template