The Cost of Living for Elders

Why does senior care and senior housing seem to have become such a problem for this generation? My first thought is that it’s just because we don’t take our parents into our home anymore, but it’s more complicated than that, so it’s good to know what’s going on.

A look at the statistics shows a drastic change in our societal circumstance. “In 1900, only 100,000 Americans lived to be 85+. In 2010, that number had grown to 5.5 million.”http://www.ioaging.org/aging-in-america That number is expected to reach 19 million by 2050.

Great! We’re living longer…but at what cost?

It’s called the cost of living. Generally speaking, when we’re younger cost of living means food, shelter, transportation, clothing, and the like. For most Americans, however, there will come a time when the cost of living includes the cost of care—both medical and non-medical. If you need help with daily living activities, or more extensive nursing care, as well as medications, the cost of living likely goes up requiring a larger portion of your income. To give it some perspective, Medicaid spending (thanks in part to the growing longevity of our population) has skyrocketed from $3.4 billion in 1973 to $13.2 billion in 1982 to $126 billion in 2010. statics compliments of http://www.ioaging.org/aging-in-america

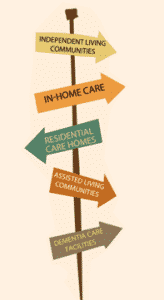

So what will you do when living alone is no longer a safe or preferred option for you? How will you pay for it? Will you move into a senior care community? According to Argentum (previously Assisted Living Federation of America), “The average cost for a private one-bedroom apartment in an assisted living residence is over $3,000 per month.”http://www.alfa.org/alfa/Assessing_Cost.asp That’s just for assisted living (apartment and meals). If you want or need a nursing care community it’s more, as is home care.

While many seniors pay for assisted living with private resources, many more must look to alternate ways to cover these living expenses. Here are a few other options to consider:

- You can sell or rent your home and use the funds to move into a senior living community that provides assistance and care.

- If you want to stay in your home, you can get a reverse annuity mortgage. This allows you to use the value of your home without giving it up. You can receive this reverse mortgage in either a lump sum or monthly payments. This option is generally not recommended for more than five years of senior housing, and is very much affected by the value of your home.

- Some care services may be covered by your health insurance. Know what they are, but don’t expect normal living expenses to be covered. You may want to consider getting a senior-living care insurance policy.

- Medicaid can be used to pay for a nursing care facility, but not all communities accept Medicaid. Keep in mind, you must qualify for Medicaid, which looks at your income and assets. Many states also offer a Medicaid waiver that allows you to use it for assisted living or in-home care. See what’s available in your state.

- Move in with family. This is a tradition that goes back centuries, and though it fell out of favor after World War II— declining from 32% of the population living in multi-generational homes in the 40’s and 50’s to as low at 26% in the 80’s— it has grown to nearly 50% in 2008. (Statistics published by the Pew Research Center http://www.pewsocialtrends.org/2010/03/18/the-return-of-the-multi-generational-family-household/. ) Much of this statistic is older adults are living in multi-generational homes, as demonstrated by the accompanying graph.

For more information about the different types of Senior Living Options, go to http://dailycaring.com/senior-housing-options-overview to read more.

These are just a few solutions. We all have to find the one that best fits our needs. Just like finding the best solution for dining with dignity. The Cravaat® is one of those stylish solutions that helps you age gracefully wherever you chose to live. So remember, when you go to the dining room in your assisted living community, you can look fashionable while you protect your clothes from spills by wearing DinerWear®. And it will make your life easier because An Ounce of Protection is Worth a Pound of Laundry.