Insurance. We get it for our homes. We get it for our cars. We get it for our health. Though we hate paying the premiums, we’re sure glad we have it when we need coverage. So, why not consider long-term care (LTC) insurance to protect your needs in your elder years?

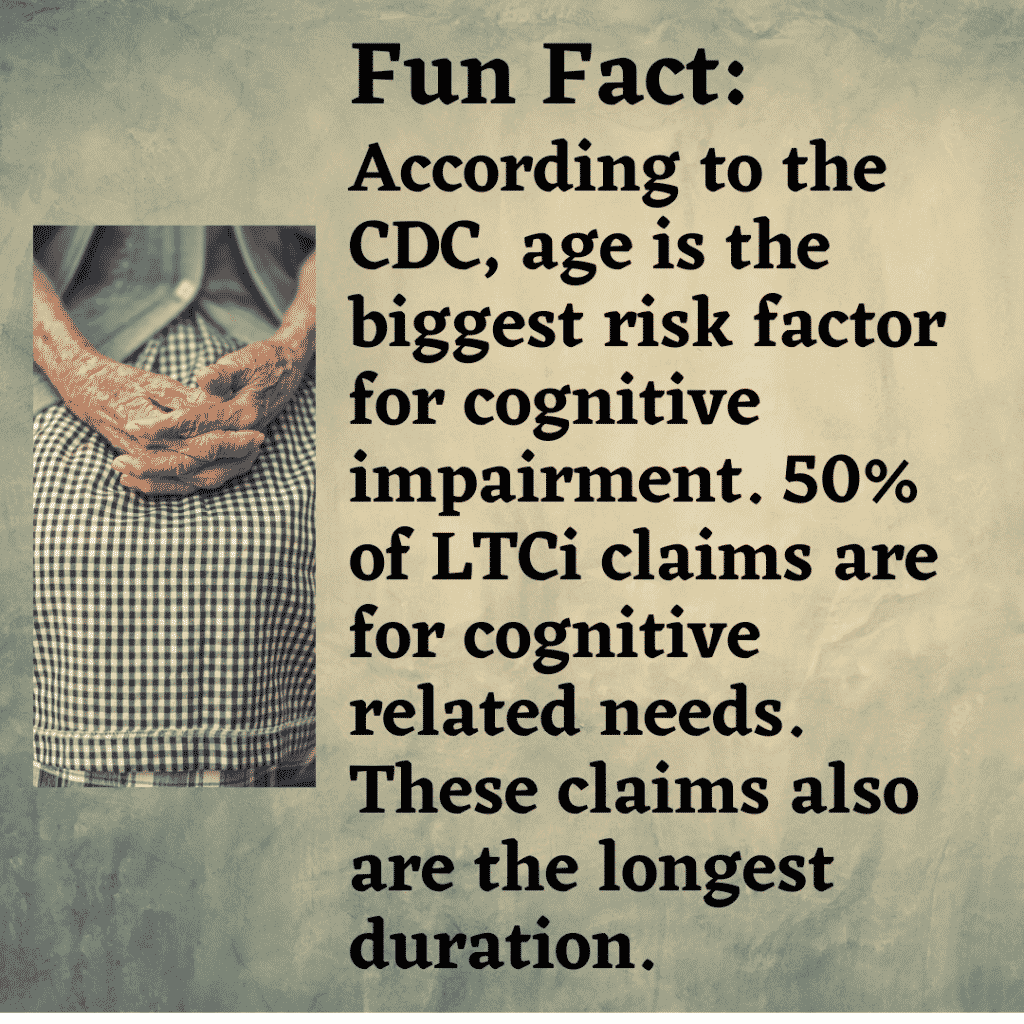

Because we’re living longer, more of us are experiencing age-related disabilities, including cognitive diseases, such as Alzheimer’s/dementia. As a result, our need for healthcare services also increases. But standard health insurance doesn’t cover all our age-related needs such as daily living assistance. That’s where long-term care insurance has your back.

What is Long-Term Care Insurance and Why You Need It.

Long term care insurance is a personal insurance policy that provides coverage for nursing-home care, home-health care, and personal or adult daycare for individuals age 65 or older, or those with a chronic or disabling condition that needs constant supervision. https://www.investopedia.com/terms/l/ltcinsurance.asp It covers caregiving costs not covered by other standard insurance policies (think Medicare).

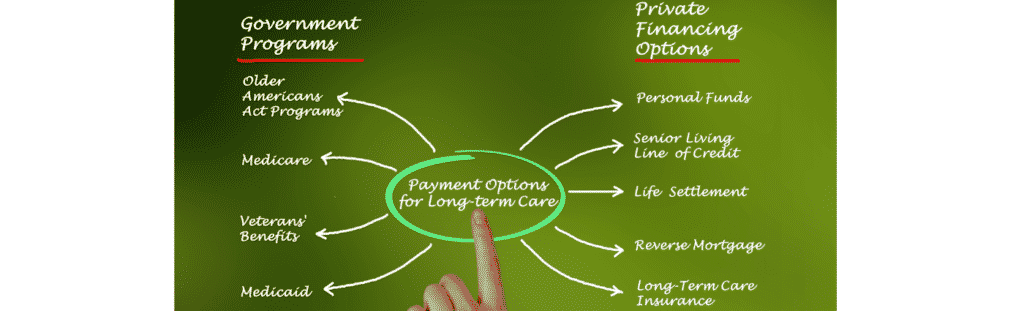

If you need help with two or more daily living activities for more than 90 days or need caregiving for cognitive impairment, regular healthcare insurance, including Medicare won’t cover it. You will either need to pay for these caregiving services out-of-pocket, or get coverage through Medicaid. To qualify for Medicaid, all your assets must be depleted, which includes a 5-year look-back, and other restrictions. So, if you have income and assets that you want to protect, or you want more flexibility and options than public assistance programs provide, long-term care insurance will allow you to keep those assets while getting daily living assistance. I also let’s you choose your caregiving options. Here’s a great article, with advice from Suze Orman, on the value of protecting yourself from out-of-pocket expenses: https://www.parkertrustlaw.com/hard-talk-from-suze-orman-about-long-term-care-insurance/.

It’s also important to understand the difference between a traditional policy (which pays a daily benefit) and a hybrid policy (which pays a monthly benefit). Some hybrid policies provide a cash benefit, as opposed to a reimbursement benefit. This will provide you flexibility in how you will use the payout. As long as you qualify for the benefit (require assistance with two or more daily living activities or have cognitive impairment), the cash can be used how you see fit. Also, some hybrid policies allow you to combine a life-insurance/annuity policy with long-term care insurance. This type of policy will cover you for care if you need it while also providing for life insurance payouts should you not need care.

Here’s a great article on hybrid policies:

The question is, can you afford the premiums?

The Cost of Long-Term Care

Like any insurance policy, you need to pay a monthly or annual premium on an on-going basis. The premium for long-term care insurance, whether a traditional or hybrid policy, will depend on:

- your age when you purchase the policy,

- single vs joint policy,

- what coverage you’re purchasing,

- how long you will receive coverage,

- your current health

- and the state you live in.

Because these factors vary so widely from person to person, it’s difficult to mention a specific price. (That’s where an insurance agent comes in.) But to get a rough idea of rates, go to: https://www.aaltci.org/long-term-care-insurance-rates/ which shows how widely prices can vary (from $1800/yr to more than $5,600/yr). While the annual premiums may sound high, like other insurance policies, when you need coverage—for costs that can run as much as four times what you paid in—you’ll be glad you had it. Whether you age-in-place, or choose assisted living, a long term care insurance policy will cover services you need, such as…

What You Are Buying

Safety is one of the biggest concerns for our elders. I recently told my mother— who is still in pretty good shape at 85—not to go down to the basement. I was worried she’d fall. I know that as she ages, she will need more and more help with everyday activities. We’re lucky. We live near each other and I have the flexibility to help her out. But if you don’t have someone for that extra help, you may have to pay for a caregiver to come to your home, which is not covered by other insurance policies. Even if you do have family caregivers, you may need extra assistance.

There are two options for getting assistance with daily living. One is with home care, where a caregiver (non-skilled) comes to your home to help you with everyday needs, such as meal prep, personal care (bathing, dressing, toileting), light housework, companionship, and transportation. Also, skilled caregivers may come to your home to help with needs such as, occupational therapy or physical therapy beyond what Medicare allows. The other option for getting assistance with daily living is to move into an assisted living community which provides many of these same services, as well as social activities. Whether you want the community atmosphere, or prefer to live in your own home, both come at a cost, and that cost is paid for by you—unless you have long-term care insurance.

The Costs

To hire a caregiver to come to your home you’ll pay an hourly rate. Let’s say that rate is $20/hr (rates vary widely based on location, and will go up in time). Let’s also say, you need someone with you for 40 hours a week. That means you’ll pay $800 per week, or roughly $3,360 per month. (To get an idea of current costs go to https://www.genworth.com/aging-and-you/finances/cost-of-care.html.) Keep in mind this is only for the cost of caregiving. You also have all your other homeowner expenses.

Compare this to senior living, which includes the daily living assistance, as well as your homeowner expenses, which makes senior living appealing. You can find a facility for roughly the same amount—though, here again, prices range widely, depending on the state you live in and the services they provide—and you also have the benefit of socialization. Either way, these expenses are paid for out-of-pocket.

However, if you have long-term care insurance, and you qualify, these expenses are covered. For example, If your policy provides $160 per day, 7 days a week, your policy would give you roughly $4,800 per month. If you need nursing care, you will likely need both your income and long-term care insurance to cover the cost, which can be as much as $5-10,000 a month.

But we’re back to the question, can you afford the premiums?

How to Pay for Long-Term Care Insurance & Will You Need It

Like any insurance policy, you have to determine the importance of having it and set that money aside. The good news is, there are several ways you can pay your premiums. Here are a few, (but your agent may help you find other options based on your situation):

- Using your income/salary

- Withdraw from your Health Savings Account (these savings plans allow up to a maximum amount to be withdrawn tax-free annually, based on your age.)

- A tax-deductible business expense (consult a tax professional regarding the specifics.)

- Retirement account minimum withdrawals

- Annuities

- Exchange a life insurance cash value

- Make a one lump sum payment, though this will cause you to lose interest income.

Generally speaking, you need to continue paying your premiums to receive the benefit. So what happens if your circumstances change?

At one time you may have had to forfeit your policy, but today, regulations require a non-forfeiture benefit. That means that if you stop paying premiums, you can still receive some benefits, either through a reduced paid-up benefit (lower payouts) or a shortened benefit period (same payouts over a shorter period of time). There also may be some additional restrictions on your claim, but at least all is not lost should you be unable to continue paying your premiums. The key, when purchasing an LTC insurance policy, is to consider all your options.

The Bottom Line

The bottom line in purchasing long-term care insurance is determining your risk aversion/risk tolerance level. Do you need the comfort of knowing you have a safety net? Or are you willing to roll the dice on where you will be when you are older, how much care you will need, and who will provide it? When you decide long-term care insurance is a wise choice, contact a knowledgeable agent and arm yourself with plenty of questions, such as:

- How is my health right now?

- What is my family’s history with cognitive diseases?

- How long do I expect to live?

- What is my health expected to be in 20, 30, 40 years?

- How will I pay for the policy for the next 20, 30, 40 years?

- Can I still afford my premiums if they go up as much as 40%, or if I lose my job?

- Will I be able to pay the premiums after I retire?

- Does the policy account for inflation (in terms of increased care costs) when I finally do need coverage?

- What does my policy cover specifically? What isn’t covered?

- How do I qualify for coverage?

- How many years will I be covered?

- Are their restrictions?

- How often can the company raise the premium? And by how much?

- If I decide to retire abroad, will my LTC policy cover my needs?

- When it’s time to make a claim, who helps find providers?

There is no universal formula to tell you exactly what will work for you. That’s why talking to an experienced agent is your best option for deciding on what to purchase. If you think you’re too old, you’d be surprised. If you think you’re too young, well that depends. Talk to an agent, ask a LOT of questions and plan ahead.

Bill Counts, of LTCi Advisors at https://www.ltci-advisors.com/ is one such insurance agent. He provided a wealth of knowledge for this article (along with Marc Glickman and John Chapman of BuddyIns – a network of LTCi professionals around the US who are dedicated to helping individuals and families find the best plan to meet their care needs while respecting their budget. https://www.buddyins.com/) If you’re ready to start asking questions, give Bill a call. He’s very knowledgeable on long-term care insurance and can help you find a policy that’s best for you.